Professional mortgage calculator app for iPhone and iPad

Developer: ramiro tamayo

First release : 28 Oct 2014

App size: 13.59 Mb

Designed by working professionals for greater accuracy. This advanced mortgage calculator not only estimates monthly mortgage payments, but it can also look up Mortgage Insurance, upfront funding fees on Government Loans and much much more.

For example, if you put down 10% on a home purchase you will have to pay monthly mortgage insurance. How much will you pay if you Credit Score is 740 and how much more will you pay if it has dropped to 620? This calculator will provide you with that information.

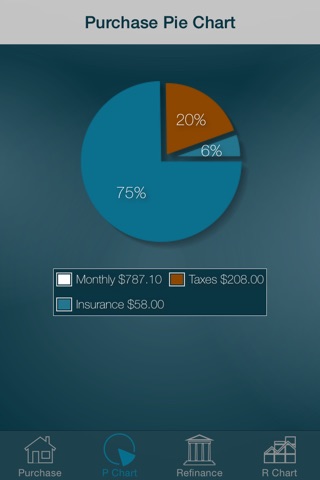

In addition, the refinance calculator allows you to compare loans side by side. The charts help visualize the results while the amortization tables provide an accurate monthly payment breakdown over the life of the loan.

This calculator is better than the rest because:

**You dont need to look up PMI Charts. Enter the Fico or Credit Score and it will look it up for you.

** Includes Property Tax in your estimates. Set the Property Tax % and it will always be included.

** Homeowners insurance can be set to local levels.

** It can look up funding fees on FHA and VA loans.

Easy to learn whether you are a Real Estate Professional or a consumer looking for greater accuracy on your estimates.

Compare these **TIME** saving features to other calculators:

* FHA monthly mortgage insurance and upfront PMI fees

* Veterans Administration Fees

* Conventional Loan mortgage insurance look up based on credit score

* Purchase Pie Chart helps you visualize how your monthly payments are distributed

* Bar Chart makes it easy to view interest savings on a refinance

* Amortization Tables give you the monthly breakdown of each and every payment

Refinance savings estimator will help you determine if refinancing is a good choice by allowing you to easily compare:

* Time to break even when closing costs are included

* Monthly Savings versus Old Loan

* Lifetime Savings when you compare both loans side by side

* Enter closing costs to obtain greater accuracy

In addition you get can customize:

* Annual Property Tax annual percentage

* Annual Homeowners insurance multiplication factors